General Information:

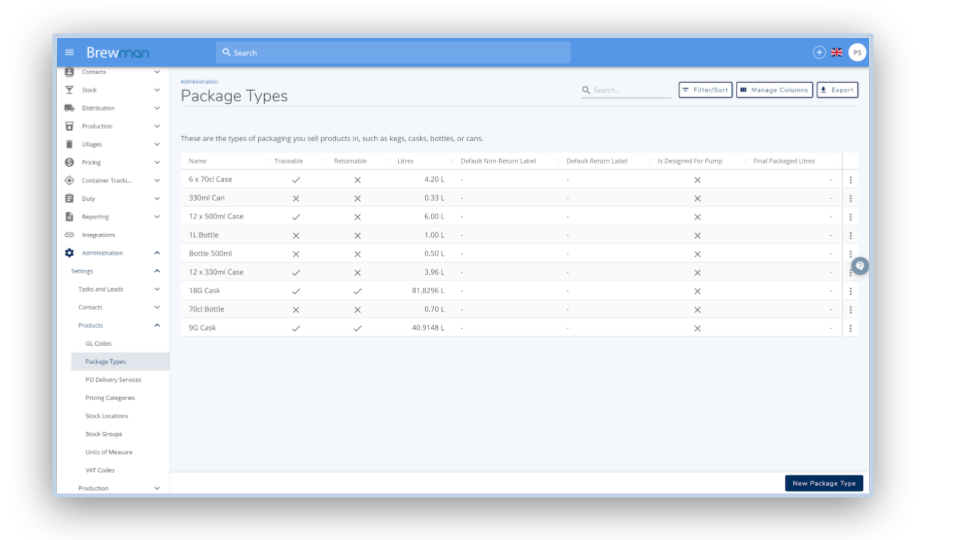

To set up your Australian Duty to be calculated correctly, you will need to start with setting up Package Types.

Package Types:

When creating or editing a Package Type, the Final Packaged Litres field must be filled in. This is the litres of each individual unit. For example, for 12x330ml Cans, the Litres columns will be 3.96L but the Final Packaged Litres is 0.33L as it refers to 1 can.

The second field required with Package Types is Is Designed For Pump. This is stating whether your Package Type is used to connect to a pressurised gas delivery system or pump delivery system as these both affect your duty rate.

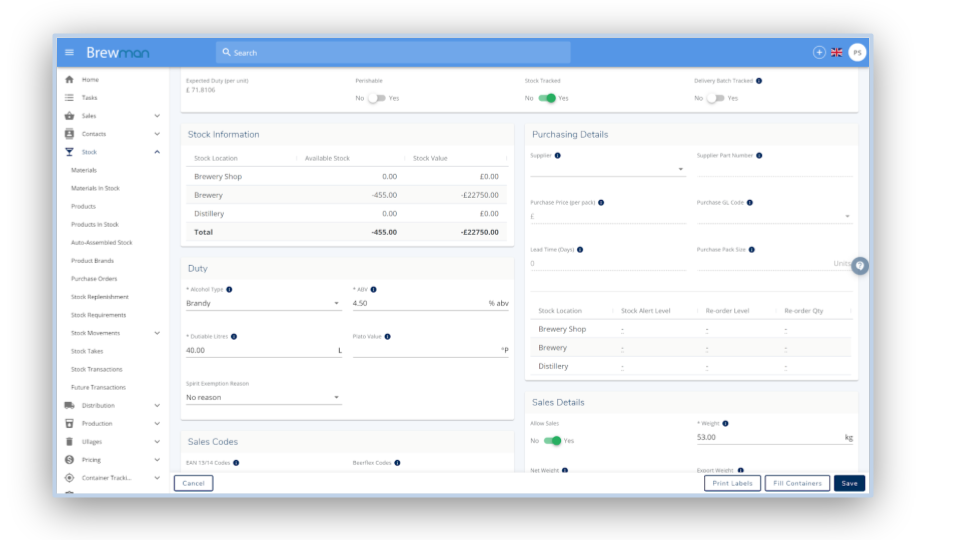

Product:

For help with creating Products click here: https://features.premiersystems.com/admin/kb/a/how-to-add-products/en

When creating a Product that is alcoholic, it is mandatory to assign a Package Type that includes Final Packaged Litres. If you do not, an error will occur when clicking finish. The Package Type associated with the Product can be changed at any time via the Settings tab.

It is also possible to edit the Spirit Exemption field when placing an order if any changes need to be made.

The spirit exemption reason's are;

Denatured

For Exempt Use

For Fortifying Wine

No Reason

Sold For Exempt Use

Alcohol Type:

Beer products - These will contain a toggle as to whether you are brewing this for personal use or not. If this is brewed for personal use, you will not incur tax.

Brandy/Spirits/Other - If selected, a field called Spirit Exemption Reason will appear. This is used if there is a reason you will not be paying duty on this product, for example, For Exempt Use would be if this is for personal use.

For Spirits, For Fortifying Wine and Denatured are exempt from duty also.

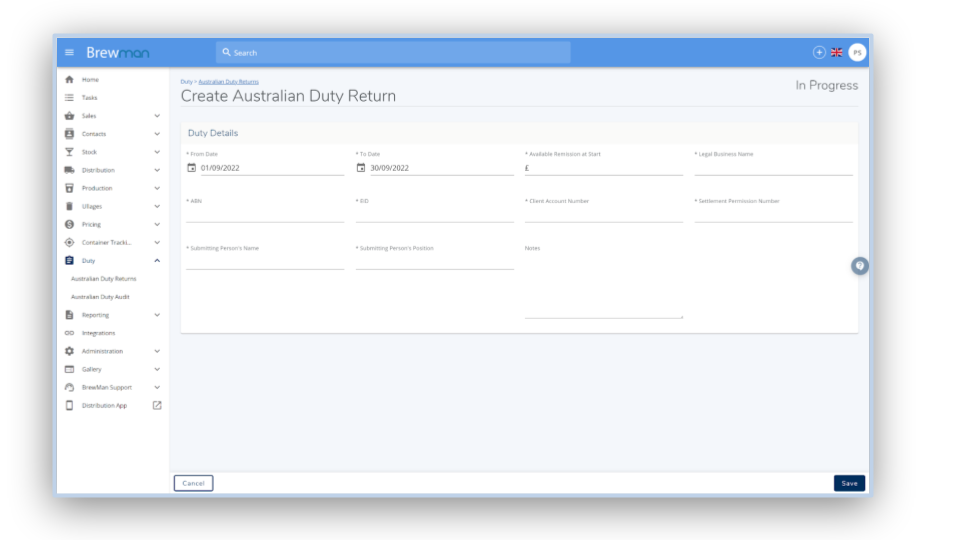

Creating Duty Return:

To create a Duty Return go to Duty - Australian Duty Returns.

Click Create Australian Duty Return. This will bring up the page below.

All of the fields with an asterisk (*) are mandatory. Following this, the fields on the duty return should be known by your company directly.

The Remission is the first sum of money that you would not pay duty on (a maximum of $350,000 per financial year). If you have already used part of your remission allowance, you will enter how much you have left currently.

All of the information supplied gets carried over to your next duty return you create. All of the information carried over to a new return can be edited.

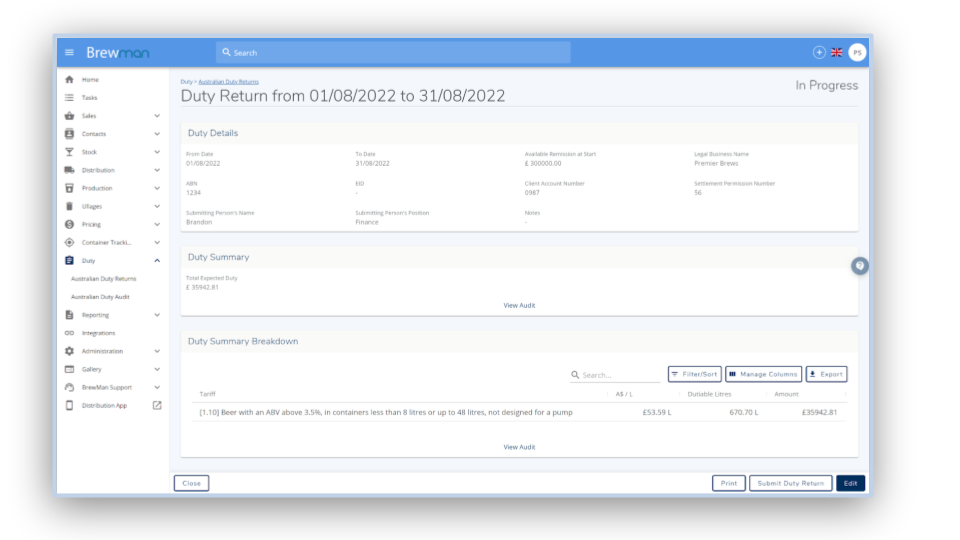

Once the duty return has been created, the screenshot below will become visible. This shows your relevant fields for this duty return period; a Duty Summary and the Duty Summary Breakdown.

On this page, click Submit Return when the duty is complete for the month, this will bring up a prompt to tell you that this cannot be undone. You will need to tick the box before being able to submit this return. This is informing you that figures will not be able to be changed later.

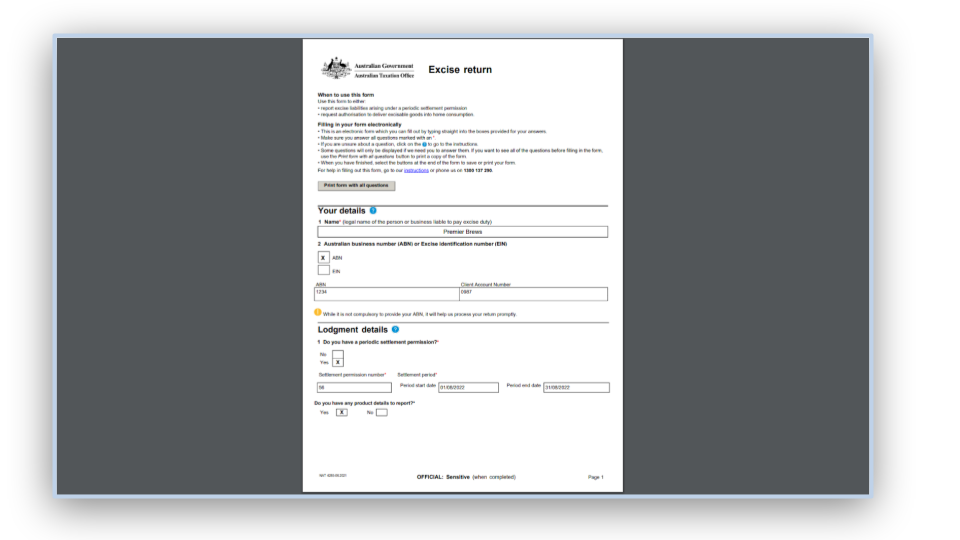

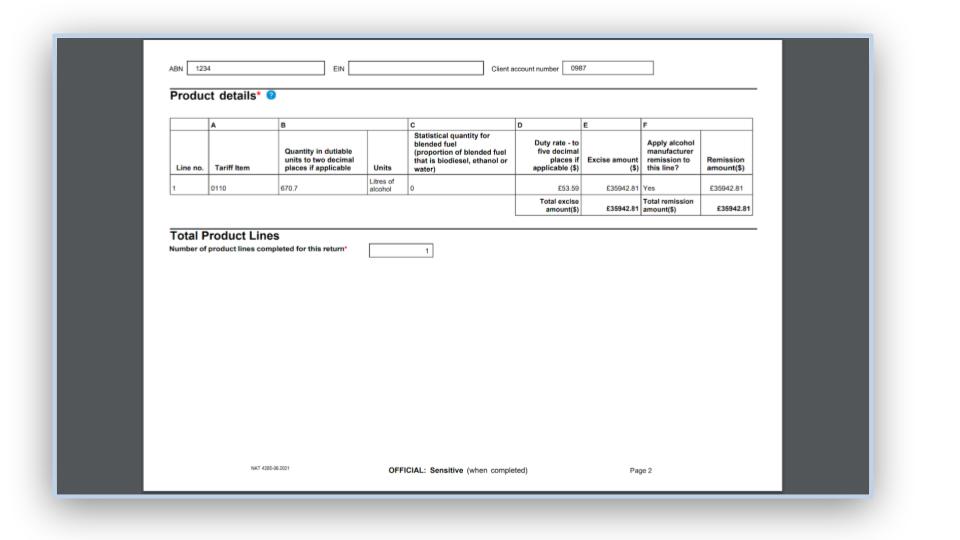

Duty Return Print Out:

On the Duty Return (as seen above) you can click Print. This generates a PDF document (as seen below) with all the relevant information to your duty return that you filled in. This can be printed and signed if sending by Post, or you can Email this directly to the Australian Taxation Office.

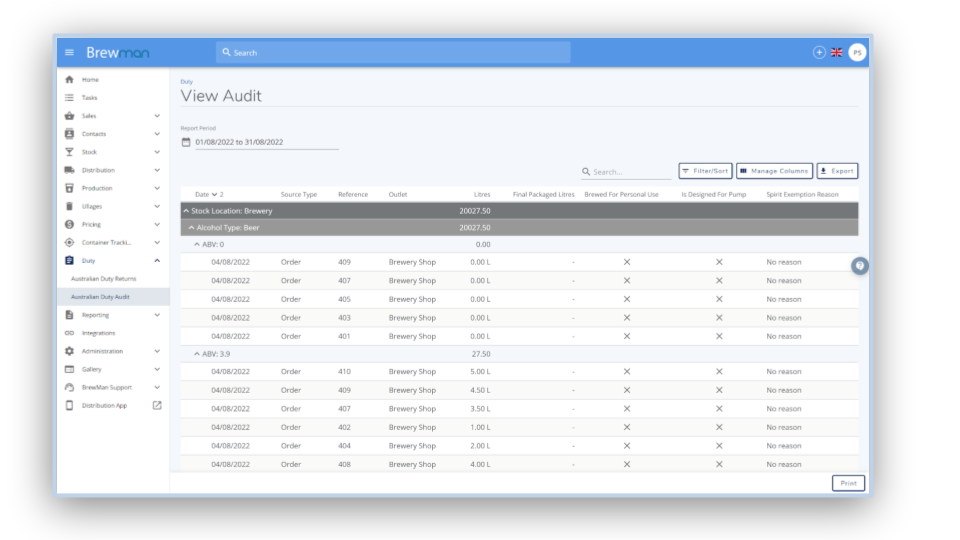

Duty Audit:

To view your Audit, go to Duty → Australian Duty Audit.

Here you can choose the given Report Period to view using the Calendar field at the top of the page.

You can Filter information provided and Manage Columns from the top of the page. This allows the information shown to be customised to your relevance.

Was this helpful?

Comments

You must be logged in to comment in this article.

Login to comment