The duty rules will allow a reduced rate of duty for producers who produce less than 4500 Hectolitres of Ethanol each year. In BrewMan you can register the annual ethanol production in Hectolitres of each Supplier (including yourself as a manufacturer) so BrewMan can evaluate the rate appropriate to each product.

The rules also allow for reduced duty rates for draught beer, Ie beer intended to be sold in pubs through a draught mechanism. The rules identify such beer as being sold in containers intended to connect to a pump or similar, and in containers holding 20L or more. In BrewMan you can register Package Types as being intended to connect to a pump, and specify the individual container size of your units of measures so BrewMan can identify and apply the reduced draught rates where applicable.

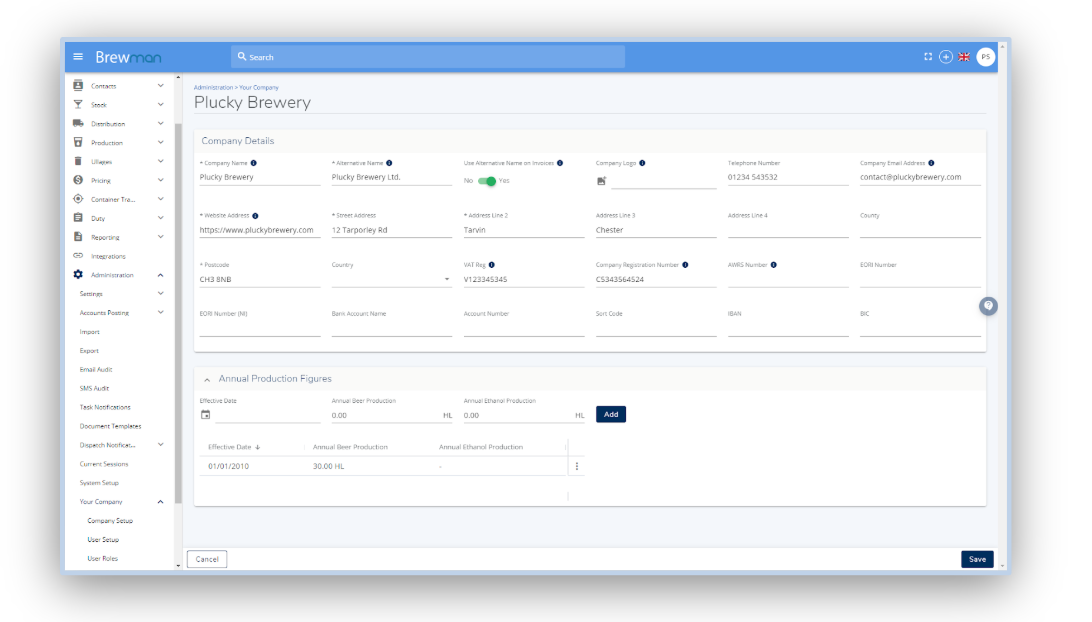

First, go to Administration → Your Company → Company Setup.

Here you can click Edit and add your Annual Ethanol Production figure.

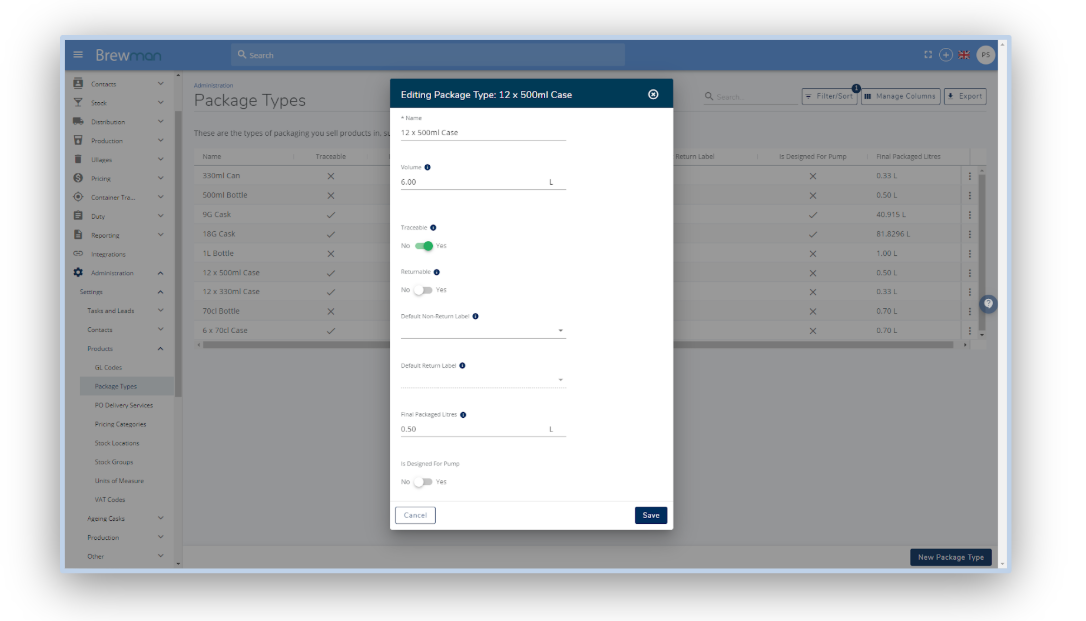

You will also need to edit your Package Types.

Go to Administration → Settings → Products → Package Types.

Against a Package Type, you can now add your Final Package Litres and state whether it is Designed For Pump.

Click the 3 dots next to each Package Type, click Edit and add the relevant information.

If needed you can create new Package Types to assign to Products.

Any orders or stock movements with a dispatch date on or past the effective date will apply the new UK duty rates.

How to Produce a Duty Return

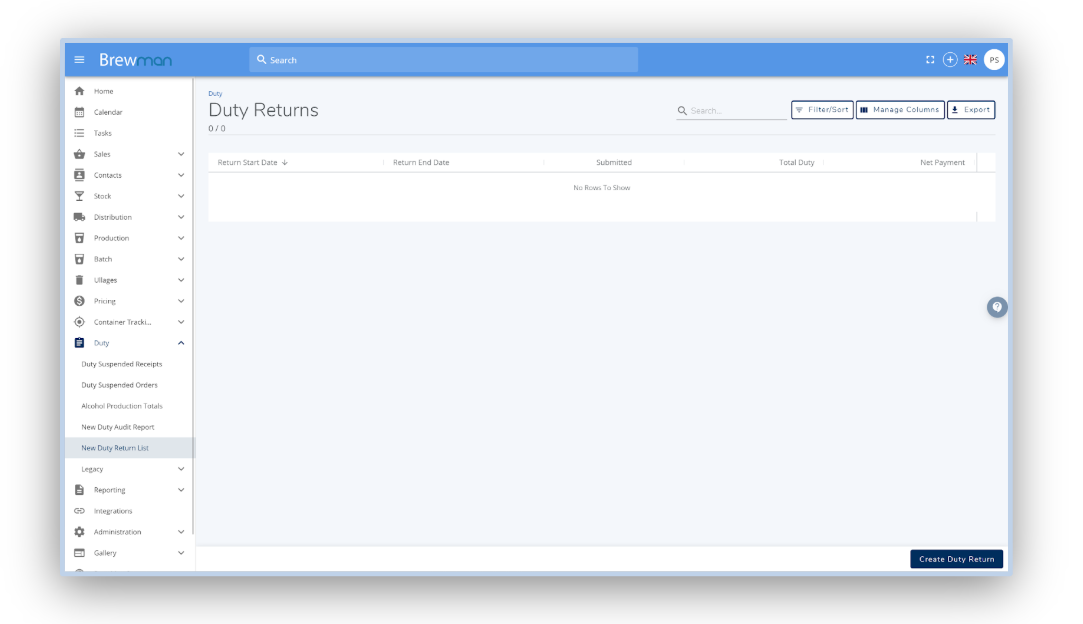

To use the new duty menu go to Duty → New Duty Return List.

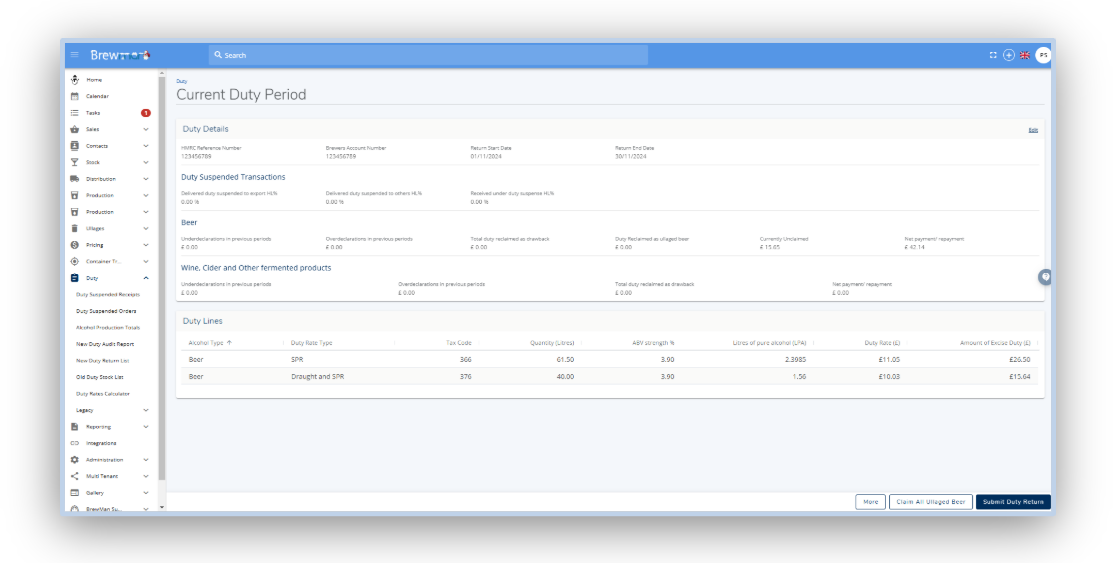

In this page, click Create Duty Return. You will be taken to the next page to enter fields such as your HMRC Reference Number and Brewers Account Number (these two fields will automatically generate for every return moving forward).

Postal Form:

For the postal form, click More → Print Beer Duty Return. This will download a PDF of the form that will need to be signed, dated and sent to HMRC.

Online Form:

For the online submission form, click More → Beer Online Submission Details. This will generate a much simpler display that follows HMRC’s guidance for the online form.

Wine and Cider Return:

If you need to submit the wine and cider return, click More → Print Wine and Cider Return. This will load out into the form needed to send to HMRC.

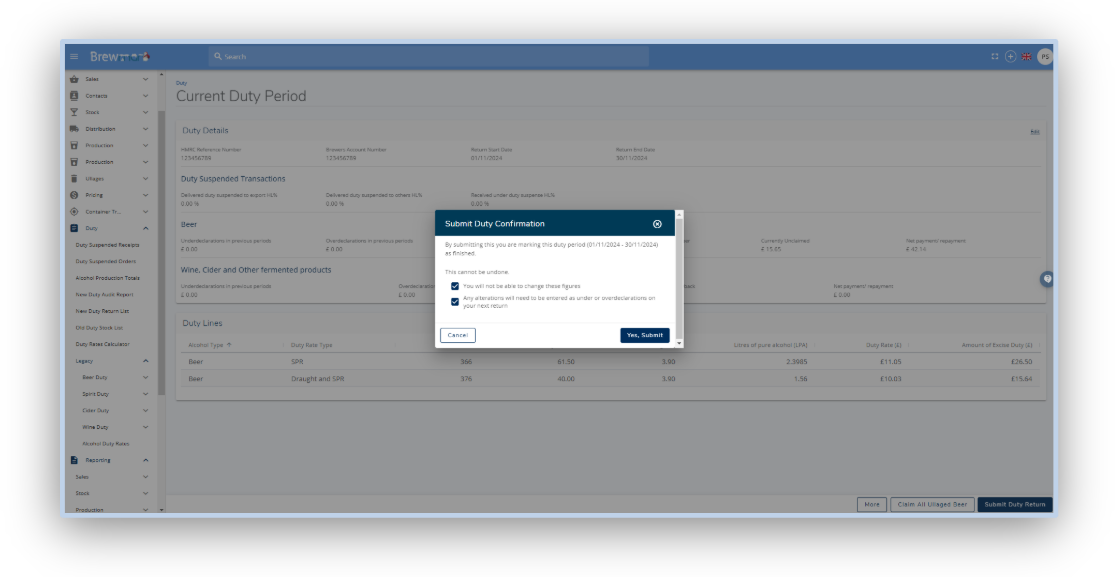

Once you are happy with your duty submission, click Submit Duty Return.

A prompt will arrive with two tick boxes, confirm these and click Yes Submit.

This will also show you if you have any uncomplete/open orders, credits and stock transfers for the month in question.

Your duty submission will now be locked on BrewMan’s side, this will prevent changing any historic transactions in that period to reflect what was submitted.

Was this helpful?

Comments

You must be logged in to comment in this article.

Login to comment